President Trump Vows To Abolish the Internal Revenue Service (IRS): “They’ve Enslaved America”

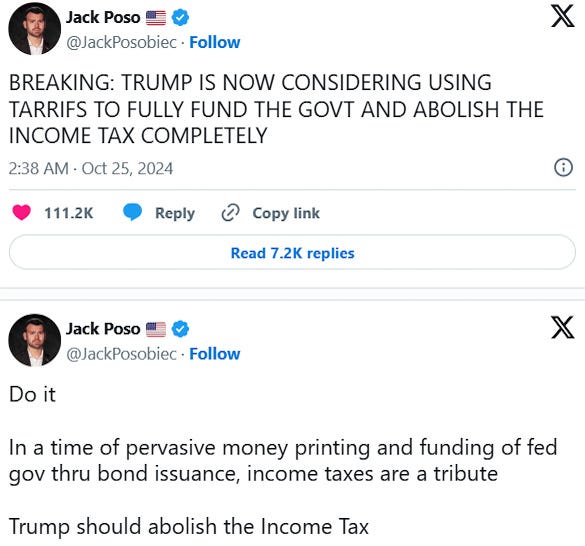

The real POTUS and Commander-in-Chief Donald Trump has repeatedly praised a period in American history when there was no income tax, and the country relied on tariffs to fund the government.

October 26, 2024

An incoming Trump administration could potentially eliminate income taxes for Americans, incentivizing economic growth and revitalizing the nation’s workforce.

President Donald Trump floated the proposal during a discussion at a barbershop in the Bronx this week when someone asked if he’d ever considered getting rid of federal taxes.

In the election’s final stretch, he raised the possibility of going even further: he vowed to abolish the Internal Revenue Service (IRS) and stop the unconstitutional taxation on the American people.

President Trump said the country could return to the economic policies in the late 19th century, when there was no federal income tax.

“It had all tariffs — it didn’t have an income tax,” President Trump said. “Now we have income taxes, and we have people that are dying. They’re paying tax, and they don’t have the money to pay the tax.”

President Trump had previously touched on the notion in June, discussing the possibility the federal government could be instead fully funded by tariffs.

Despite the groundbreaking proposal, the Times predictively went on to cut down the idea, arguing such a scheme would be “mathematically impossible and economically destructive,” while President Trump maintains, “There is a way if what I’m planning comes out.”

Giving a refresher on the origin behind the tax on Americans’ work earnings, The Times went on to explain, “The United States put income taxes in place to achieve two main goals: raising taxes on the rich and paying for a larger federal government,” and an expert claims the tax was seen as “a necessary leveler” to combat wealth inequality.

The publication also highlighted how most federal funding now comes from income and payroll taxes instead of tariffs.

Tariffs dwindled as a source of federal revenue while income taxes expanded. Today, tariffs make up just 2 percent of federal revenue, while income and payroll taxes make up about 94 percent.

Overall, the tax system is progressive: In 2020, the top 20 percent of earners in the United States paid about 80 percent of all federal taxes, according to the Congressional Budget Office.

News the rightful President Trump could get rid of income taxes was hailed on social media, including by former Congressman Ron Paul, who wrote on X, “Now this would REALLY make America great again!”

Although not a formal policy proposal, Americans are fed up with being overtaxed by the federal government on everything from gas to food, cars, and land, and the appealing idea of eliminating income taxes – regardless of the consequences – offers yet another way President Trump could make America wealthy again.

Video from President Donald Trump's visit to a New York City barber shop quickly spread online Thursday afternoon, with supporters saying the visit showed he was "authentic."

The Republican presidential candidate was at the King of Knockouts barbershop in the Bronx, ahead of his Al Smith charity dinner later in the evening.

President Trump spent around an hour inside the shop, according to local news reports, speaking with customers and barbers as the New York City Police Department and U.S. Secret Service guarded the area.

Footage was shared on X, formerly Twitter, by one of President Trump's senior advisers Steven Cheung and his deputy director of communications, Margo Martin, with both clips seeing over 250,000 views within a couple of hours.

WATCH: Steven Cheung on X: "BRONX: @realDonaldTrump visiting Javiel’s Barbershop in the Boogie Down! " / X

President Trump's visit to the Bronx is not the first of this election cycle. He held a rally in the borough in March, where he promised to help Democratic leaders if he was elected for a second term in the White House.

"As soon as I get back into the Oval Office, I am going to pick up the phone and I'm going to call your mayor and your governor, and I'm going to say, 'this is President Trump and I want to come back and help,'" President Trump said at the time. He was a lifelong New Yorker until he officially transferred his residency to Palm Beach, Florida, in 2019.

His attention on New York, which came most recently with a rally on Long Island, is unusual for a Republican candidate when the state is generally a stronghold for the Democratic Party.

The state has voted blue for the past nine presidential elections and Trump lost by a margin of around 33 percent in both 2016 and 2020.

Castle Hill, the neighborhood President Trump visited Thursday, sits within New York's diverse 14th Congressional District, currently represented in the House by Woke Democrat Representative Alexandria Ocasio-Cortez.

It has had a Democratic Party representative since 1926 and voted blue in at least the last six presidential elections.

While New York is seen as a solid blue state, the Republican party still enjoys widespread support in its rural and suburban areas, and this year the gap between the GOP and the Democrat Party could be narrowing.

In the 2024 presidential election, President Donald Trump has the potential to gain the largest share of the vote in the Empire State than any other Republican candidate since 1988, some polls have suggested.

READ MORE:

President Trump to Abolish Internal Revenue Service (IRS)

When President Donald J. Trump makes an official return to office, he will sign an Executive Order abolishing an institution that has fleeced hard-working American citizens since its inception in 1862.

That organization is, of course, the Internal Revenue Service. Archaic and dysfunctional, the IRS, which President Donald Trump has called “the deepest depths of the Deep State,” has defrauded working citizens of incalculable sums.

Share or comment on this article.

Your support is crucial in exposing fake news and in helping us defeat mass censorship.

Lord we sure hope so.